The Costs of Waiting

Purchasing life insurance now versus later

There’s always tomorrow — except when there’s not. Many people put off buying life insurance for various reasons, even

though they say they need it. According to research conducted by nonprofits LIMRA and Life Happens, nearly 31% of non

owner respondents say they need life insurance coverage.1 But one thing they may not consider is the cost of waiting. Here

we explain why time may be of the essence for some when it comes to purchasing life insurance now versus later.

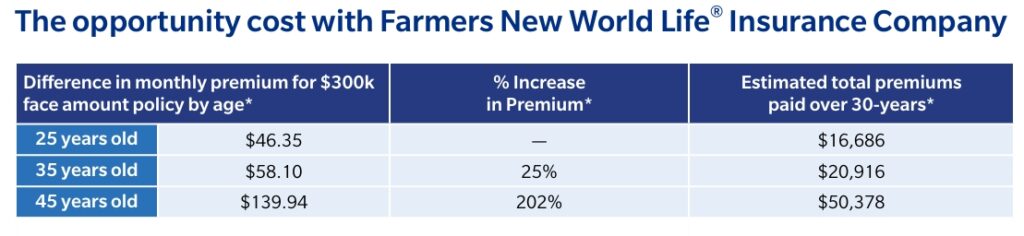

Life insurance premiums increase with age

Generally speaking, the younger you are, the less you’ll pay in premiums. While there are many factors that determine how

much you’ll pay in insurance premiums, age plays a big role and makes a strong case for buying life insurance as early in life

as possible.

Early bird advantage helps to lock in future insurability

Health is an important indicator of the premium payable. As you get older and potentially less healthy, the rates you pay

could be high, or you may be ineligible to purchase the coverage you want. Protecting your future insurability now is an early

bird advantage that your future self may be thankful for.

Young people can be vulnerable too

Younger individuals typically have limited savings but may have a high number of dependents and liabilities. These could

be parents who are approaching retirement age, younger siblings who have yet to enter college, or even grandparents with

critical ailments. To assist beneficiaries in the event of an untimely death, proceeds from a life insurance policy could provide

financial protection for unpaid loans or other debts you may incur or be liable to.